Bitcoin Spot ETFs are likely to receive the US financial regulator’s approval as early as this week, according to a Bloomberg report. BTC holders are awaiting the Securities and Exchange Commission’s (SEC) greenlight on the securities product with the upcoming deadline on January 10.

Bloomberg reports that insiders speculate the regulator will use the January 10 deadline to announce their decision on several Spot Bitcoin ETF applications at once. Nearly a dozen applicants are awaiting the SEC decision and have lined up seed capital and marketed their Spot BTC ETF product.

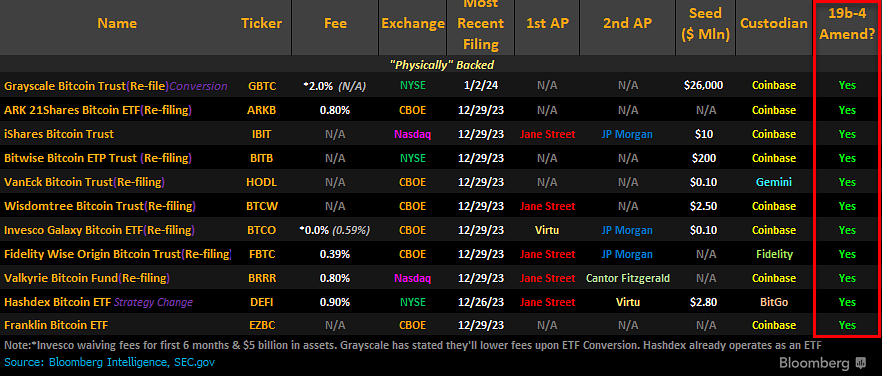

Daily Digest Market Movers: Grayscale Investments files amended S-3, drops fee details and names APs

- Grayscale Investmens, one of the largest cryptocurrency asset managers in the ecosystem amended its S-3 filing, according to a recent Reuters report. The asset management giant set a 1.5% fee for its proposed Bitcoin Spot ETF.

- The crypto asset manager named Jane Street, Virtu, Macquarie, Flowtraders, Flow Desk and ABN Amro as authorized participants for its ETF product. Authorized participants handle the redemption/ creation mechanism for an ETF.

- Bitcoin Spot ETFs could be approved if two technical requirements are met.

- The SEC has set a deadline for 8 AM ET (1300 GMT) on Monday for issuers to file their amended S-1 forms. For a Bitcoin Spot ETF to start trading the SEC requires: 19b-4 filings from exchanges and S-1 forms from issuers. The amendment to S-1 forms and 19b-4s are in, according to the latest update on the SEC website.

- The regulator needs to sign off on these two to kickstart ETF trading, as early as a day after.

- The SEC has to approve the amended S-1 forms from issuers and a potential approval is likely as early as Tuesday or Wednesday this week.

- According to a Reuters report, a source indicated that the SEC Commissioner vote will likely take place on Wednesday, marking this week as key for Bitcoin holders and market participants.

- All 11 ETF issuers have amended their 19b-4 and S-1s are awaiting approval for Bitcoin Spot ETFs to hit the market.

- Monday to Wednesday this week are key dates for issuers and market participants to watch out for updates and changes in the SEC’s decision on the new securities product.

- Bloomberg reports that BTC ETF approval would usher a watershed moment for the digital asset industry as there are billions of dollars at stake.

- Both retail and institutional investors are expected to pour their capital in the new securities product and crypto experts like Michael Anderson of Crypto Venture firm Framework Ventures believes that the market is underestimating the potential impact of an ETF approval.

Technical analysis: Bitcoin price could find its way back to $45,000

Bitcoin price is in an uptrend that started on September 11, 2023. BTC price has consistently formed higher highs and higher lows with the exception of December 2023 where prices traded sideways below the $45,000 mark for a large part of the month.

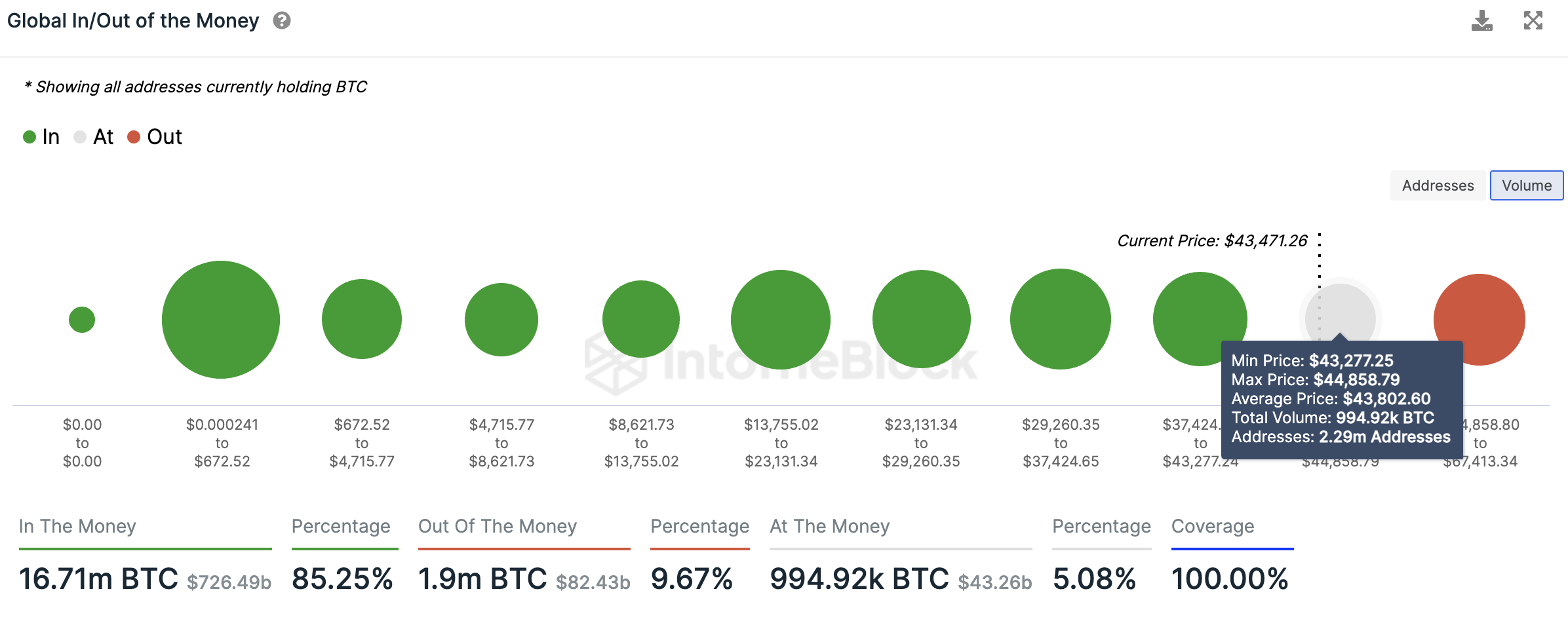

For Bitcoin holders, $45,000 is a psychologically important level as between $43,277 and $44,858, 2.29 million wallet addresses bought 994,920 BTC worth approximately $43.57 billion (at an average price of $43,802, as seen on IntoTheBlock).

Between November ‘21 and November ‘22, Bitcoin price nosedived from its peak of $69,158.74 to low of $15,541.05. BTC price has sustained above the 50% Fib level ($42,349.89) of this drop in January 2024, and the largest cryptocurrency eyes a recovery to $45,000.

Bitcoin price is currently above its two long-term Exponential Moving Averages at 50-day and 200-day at $41,337.99 and $34,211.52 respectively.

The next key resistance for Bitcoin price is the 61.8% level at $48,676.78.

A daily candlestick close below the 50% Fib level at $42,349.89 could invalidate the bullish thesis for Bitcoin price. BTC could find support at $41,338.66, its 50-day EMA, in its downtrend.